Local authorities can now make a meaningful contribution to affordable housing. We look at their ambitions, plus the growing influence of For Profit Registered Providers

Local authorities: sleeping giants ready to re-engage?

Not-for-profit housing associations have been the engine room for new affordable housing delivery since the decline of local authority housebuilding. However, with the abolition of the Housing Revenue Account (HRA) borrowing cap, local authorities potentially have the financial firepower to re-engage in housebuilding.

More than 70% of local authorities indicate they plan to increase their delivery of homes for social rent, affordable rent and shared ownership

Savills Research

More than 70% of the local authorities who responded to our survey indicate they plan to increase their delivery of homes for social rent, affordable rent and shared ownership. More than 25% envisage a big increase.

This reflects the ambitious development programmes announced by many local authorities. For example, Southwark aims to deliver 11,000 new council homes by 2043, while Ealing has adopted London’s largest council housebuilding programme, targeting 1,138 genuinely affordable homes by March 2022.

The obstacles

Local authorities will need to adapt to achieve their delivery ambitions and contribute significantly to housing delivery.

Political pressures and cycles are cited as constraining factors by our focus groups. While local authorities often want to build new homes regardless of political allegiance, decisions can often be based on short-term political interests, which may not marry well with longer-term development programmes.

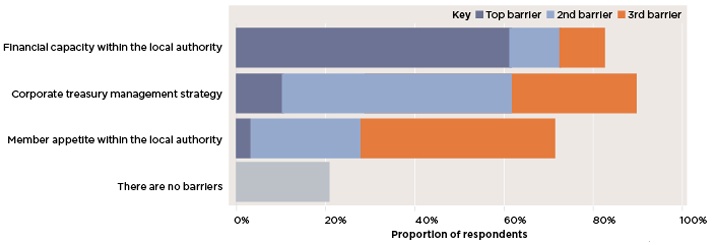

Despite the lifting of the HRA borrowing cap, 61% of local authority respondents cite financial capacity as the main funding barrier. It may be that authorities are responding to the general austerity affecting their budgets. It may be that many have still to work through the full implications of the new flexibilities.

It is also important to remember that 48% of local authorities do not have a housing revenue account. Many need to develop a significant revenue stream and explore alternative models of specialist housing development companies. The lifting of the HRA borrowing cap has undoubtedly opened up opportunity, time will tell if they can capture it.

The most significant perceived constraint on local authority development is a lack of land, which is surprising given the extent of their property holdings. That suggests many of the most obvious development opportunities have been sold off and a more proactive approach is needed to identify future potential development sites.

Other obstacles are similar to those experienced by housing associations. But where they differ most is the extent to which their organisational capacity is considered a limiting factor. While 22% of housing association respondents believe that this acts as a major constraint on their ability to build more homes, the figure rises to 45% of local authorities.

Our focus groups feel that many (though not all) local authorities have lost the expertise and experience needed to engage in significant housing delivery. Concerns are expressed over their ability to recruit skilled technical development staff within existing pay frameworks.

Consequently, partnerships across local authorities, with registered providers and the private sector, are either ongoing, planned or being considered over the next five years by the majority of respondents.

Local authorities What are the top three funding barriers?

Source: Capacity survey

For Profit Registered Providers (FPRPs): disrupting the future direction of the sector?

The amount of stock held by FPRPs has increased by 149% in the past year (albeit from a low base of 873 units). This is leading to concerns that they are diverting funding from traditional housing associations and affecting pricing in the Section 106 market. Press coverage has served to exacerbate this public perception that FPRPs are changing the direction of the sector.

Despite this, 72% of respondents believe that FPRPs have a role to play in solving the housing crisis. Arguably, FPRPs have challenged and refocused the sector, with respondents describing them as ‘alternatives with a different agenda.’

Our focus groups are divided on the role of FPRPs, but note a tendency within the sector to view new players with scepticism. The results suggest much of this focuses on the perceived tension between delivering housing as a social good and returns to investors. This is perhaps best demonstrated by the fact that 65% of respondents to our sentiment survey feel that FPRPs are less concerned with tenant welfare than traditional providers.

Though FPRPs are subject to the same regulatory standards as other registered providers, our focus groups also highlight the need for them to demonstrate ongoing good governance and a social conscience that overrides a desire to maximise profit.

Where FPRPs score well is in their ability to introduce innovative development and their potential to deliver additional affordable housing by using institutional funding to boost overall capacity.

The biggest increase in affordable housing delivery by For Profit Registered Providers is in low-cost home ownership

Savills Research

So, what is the role of FPRPs? The biggest percentage increase in affordable housing delivery by FPRPs between 2017 and 2018 is in the provision of low-cost home ownership.

Here, output rose 23% last year. It is a sector of the market that appears to be well-suited to the FPRPs. It is also one which will assume heightened importance when Help to Buy ends in 2023 (See our 2019 Spotlight: Shared Ownership).

FPRPs that deliver housing at different price points and across different tenures and through different mechanisms can be supportive of traditional housing associations and local authorities. An example of this is traditional housing associations moving towards more land-led development, giving FPRPs a clear role to play in delivering Section 106 homes.

The opportunity is to find more areas where FPRPs can provide additional delivery, because, as one of our focus group notes, “there is enough of a housing crisis to go around”.

Read the articles within The Savills Housing Sector Survey below.

.jpg)