Housing associations are becoming more active in the land market. Trouble is, they’re not the only ones

Availability of land continues to be a challenge. It’s the standout factor, with 78% of housing association (HA) respondents citing it as the main constraint on development. And, as the range of players in the land market diversifies, housing associations face more competition, which pushes up land values.

Housing associations are increasingly happy to take on land-led development as it gives them ownership over the development process, and allows them to retain control over what is built and how it is built.

Land-led development gives HAs ownership over the process, and allows them to retain control

Savills Research

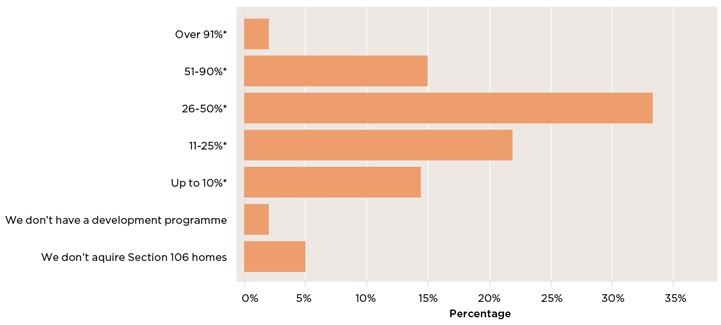

The competition for Section 106 and some high-profile issues with the quality of stock coming through, have also encouraged some providers to change their focus towards land-led provision. With 33% of housing association respondents using Section 106 homes for 26%-50% of their development programme, we expect to see this decline as providers pursue land-led opportunities, dependent on grant availability.

Section 106 homes Proportion of housing association respondents who use Section 106 homes in their development programme

Source: Capacity survey | Note: *Proportion of development that is S106

We have seen greater activity from housing associations in the land market over the past year. The majority of this is for small sites between 50 and 100 units, with bidding activity rising by 150% in the past two years, as reported by Savills land agents.

Some 39% of associations already have strategic land and 64% are seeking to acquire some within the next five years, a slight increase on last year. This marks the continued ambition to move towards a strategic approach to land.

Last year, we discussed the risk of competition for Section 106 stock within the sector. This year, there is the same risk of competition, but it is now moving to the land market. The increase in smaller sites sold to housing associations of between 50 and 100 units highlights the sweet spot of demand.

Survey respondents suggest that as larger providers move into local regional markets, there is a greater risk of housing associations outbidding each other and artificially inflating land values.

Access to land is becoming more fundamental to the sector, with both housing associations and local authorities actively pursuing it. Faced with a shortage of land supply, partnerships and an enabling policy focus – such as the recommendations in the Letwin Review – are needed to help improve access to land opportunities.

ESTATE REGENERATION

Driven by social purpose, estate regeneration offers the scope to redevelop estates and improve housing conditions, creating new sustainable communities. This can be achieved by replacing existing poor-quality stock and tackling the stigma of social housing.

From our survey, 91% of respondents believe that estate regeneration has a role to play in solving the housing crisis. They feel that development potential in existing land and vacant sites can be unlocked through regeneration and that there is opportunity to increase density in some sites. But the message was clear: post-Grenfell, the housing crisis is considered much more multi-faceted than building more homes.

Despite estate regeneration being a core pillar of the sector, our focus group recognises the vast complexities and challenges involved. Regeneration is a longterm process that serves as a drain on finances and resources. Balancing viability with delivering the right outcome for residents is key.

Our focus group believes that the sector requires a pot of money for estate regeneration and a separate funding source for delivering new homes. They also note a planning and housing policy gap around estate regeneration that inhibits activity. The debt cap removal could boost local authority estate regeneration as it provides some much-needed funding firepower, but public policy must provide more backing for the process.

Read the articles within The Savills Housing Sector Survey below.

.jpg)