Which issues are rising up the housing priority list?

1. Brexit

With the uncertainty of Brexit continuing to loom over the housing market, respondents view Brexit in a more negative light than they did in 2018.

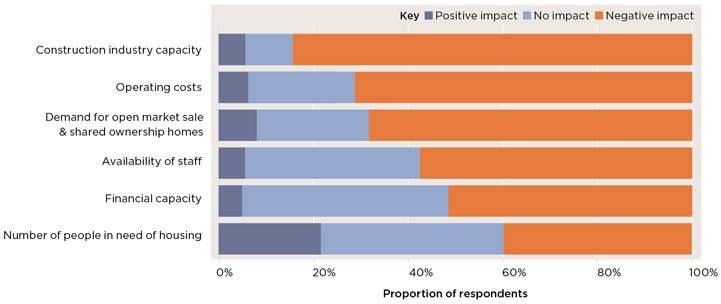

Brexit has had the biggest negative impact on construction industry capacity and operating costs, affecting the sector’s development activities. It has also driven up operating costs in the sector, affecting materials and labour prices. Our focus groups feel that Brexit is exacerbating existing problems, such as retaining and recruiting staff.

Respondents agree that the capital markets seem largely unaffected, with cheap debt readily available despite the shadow of Brexit

Savills Research

The sector is more exposed than ever to housing market fluctuations, and Brexit-related sentiment is having a negative impact on the housing market (see our 2019 Spotlight: Mitigating Market Risk). The proportion of respondents who are concerned that a Brexit-related market downturn would affect their development activities is now 33%. That is up from 27% in last year’s survey.

However, respondents agree that the capital markets seem largely unaffected, with cheap debt readily available despite the shadow of Brexit. They identify bigger challenges to funding, which, in the case of housing associations, are gearing and cash-flow capacity. Local authorities cite financial capacity as their top funding barrier, an unexpected response, perhaps, given the abolition of the debt cap.

Political influence To what extent do you think Brexit will impact on the following aspects of your organisation’s activities?

Source: Capacity survey

2. Homelessness

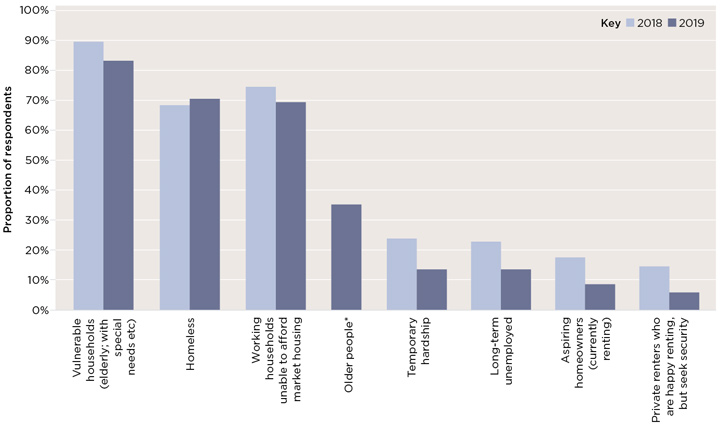

Homelessness is one of the most visible symptoms of the housing crisis. It has risen quickly up the domestic political agenda and become an increased priority for respondents since last year’s survey. The proportion of respondents who place housing homeless households as their top priority has increased from 31% to 39%.

According to MHCLG, there are more than 90,000 homeless households living in temporary accommodation, 63% of which are in London. A study by Crisis reports that more than 30% of statutory homelessness acceptances come from the private rented sector.

That makes housing the homeless a complex policy issue, spanning both the social and private rented tenures, and welfare policy more generally. The response is typically shaped by both the political imperative and the legal responsibility, with both housing associations and local authorities invested in finding solutions.

The private sector is also part of the solution. It provides leased temporary and settled accommodation, and short-term crisis relief housing to help local authorities fulfil their legal responsibility. Almost half of respondents (47%) are building short-term crisis relief housing, for example.

Our focus groups noted that longer-term accommodation alone is rarely enough for those who have been homeless for some time. Additional services are needed to avoid people living as if they were still homeless.

Who do you think the sector should be trying to house? Three groups stand out as clear priorities, but only homelessness has increased from 2018

Source: Sentiment survey | Note: *Not surveyed 2018

3. Older persons’ housing

Our survey shows that of all the forms of specialist housing provision, the sector has the greatest appetite to deliver retirement housing in volume. Some 77% of respondents expect to build homes targeted at the older persons’ segment.

Retirement housing is an increasingly important tenure. International benchmarks suggest we should be providing specialist housing for around 15% (1.2 million) of households aged 65 or over. However, only 726,000 such homes are available (see our 2018 Spotlight: Retirement Living). There needs to be more focus on specialist delivery and recognition of the wider benefits it can bring to an organisation. For example, a specialist housing off er from providers can encourage existing tenants to ‘rightsize’. This helps with turnover of stock and takes pressure off tenant services.

Across all the forms of specialist housing provision, 77% of respondents expect to build homes targeted at the older persons’ segment

Savills Research

A concern raised by our focus groups is that much of the existing older persons’ housing stock is not fi t for purpose – particularly that which was built in the 1960s and 1970s. Of the 730,000 retirement housing units across the UK, 52% were built or last renovated more than 30 years ago (Elderly Accommodation Counsel, 2019).

High rates of obsolescence and an ageing population appear to be behind the drive to deliver new purpose-built retirement stock. With a desire to break a cycle of build-use-dispose-rebuild, this requires developing stock with enough flexibility to meet evolving care requirements.

Funding for social care provision is limited, so delivering extra-care housing is highlighted as a particular challenge, especially when it is competing for funds within organisations. But there are successful examples which are likely to act as models for future delivery within this tenure.

4. Modern methods of construction

Our capacity survey indicates that the sector is moving towards more modern methods of construction (MMC). Some 69% of respondents aim to use these methods to deliver between 10% and 50% of their development programme in the next five years. This is a big shift from current utilisation.

The 5% of respondents who plan to deliver 100% of new homes through using MMC tend to be smaller with smaller development targets.

MMC directly addresses some of the challenges faced by the sector in terms of shortage of materials, skills and construction capacity. Our focus groups suggest that offsite manufacturing is well suited to the sector as it can speed up delivery and increase the quality of new homes delivered. Faster delivery means rental income is received more quickly and grant can be drawn down earlier, reducing interest payments on capital to fund developments.

Some housing associations have their own facilities and are at the forefront of utilising MMC. Swan Housing, for example, opened its own vertically integrated modular factory in October 2017 and plans to build 600 homes a year.

Those housing associations not in a position to invest in their own manufacturing facilities will have to adapt their procurement routes to deliver MMC. Local authorities are also pushing ahead. There is a pan-London group of councils that is working to supply 200 modular temporary accommodation homes by 2021.

Read the articles within The Savills Housing Sector Survey below.

.jpg)