Growth in online shopping set to boost demand for warehouse space

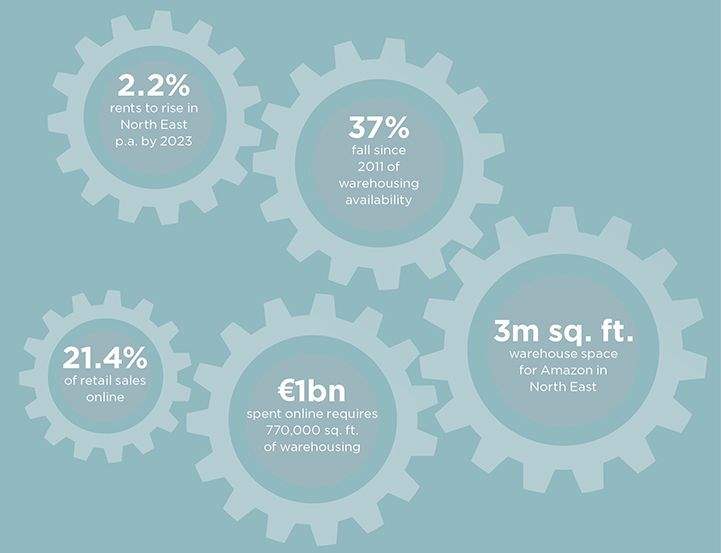

The growth of the Industrial market in the UK is well documented and in the most part has been driven by the continued growth of online retail, which in November 2018 set a new record with 21.4% of all retail sales being recorded online. Research from Prologis states that for every additional €1bn spent online an extra 770,000 sq. ft. of warehouse space is required.

Until recently the North East may have felt comparatively overlooked when it came to benefitting from this surge in demand; however, 2018 saw a sea change as Amazon committed to over 3m sq. ft. of warehouse space in the wider North East, taking build-to-suit facilities in Durham and Darlington. Combined with regular market churn this meant that for units over 10,000 sq. ft. a new take-up record of 4.7m sq. ft. was set.

Not only will this change the perception of the market to many but we anticipate suppliers into Amazon to require space as has happened in other regions when packaging suppliers, for example, take warehouse space close to their fulfilment centres.

Landlords and developers would be advised to consider speculative development of good quality industrial space

Savills Research

The wider North East region is also benefitting from the agglomeration effect of having major car manufacturing in the region, and notwithstanding current geo-political sensitivities around Brexit, we expect major suppliers to the automotive sector to continue to locate in the region, which will be amplified as R&D progresses into alternative fuel vehicles.

Lastly, we expect to keep a watchful eye on the progress of HS2, and in particular when the contract awards for the rolling stock construction are made. The North East already benefits from the assembly of trains in Newton Aycliffe and if further awards were to be made this would again benefit local suppliers and the supply chain that goes with it.

However, the supply of warehousing has fallen to just over 8m sq. ft. in the wider region, a fall of 37% since 2011, and much of this vacancy is of grade B & C quality and arguably not fit for purpose in today’s modern manufacturing and retail supply chains.

With rents in the North East set to rise by 2.2% a year by 2023, in percentage terms more than many other established regions in the UK, landlords and developers would be advised to consider speculative development of good quality industrial space or the refurbishment of second hand stock to bring it to modern standards.

.jpg)

.jpg)