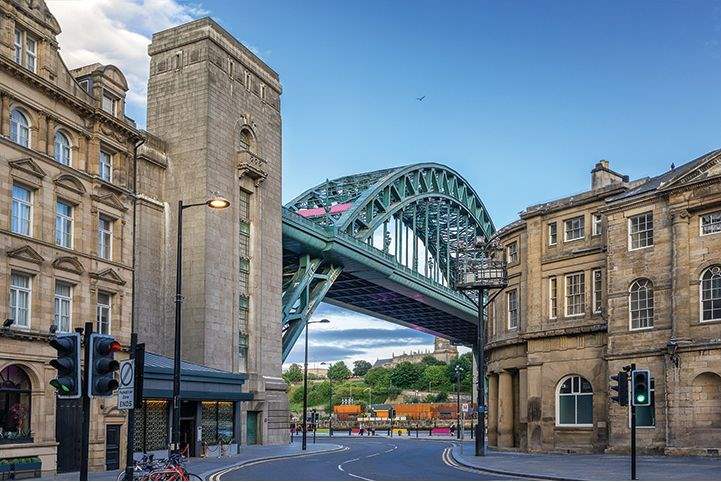

As an affordable location that is attracting public and private investment, new opportunities are beginning to emerge in Newcastle

Challenges and opportunities

Newcastle is one of the fastest growing cities in the UK, with 21,000 new homes and 14,000 new jobs expected over the next 12 years. The city’s population is projected to reach over 310,000 by 2030, an increase of 6% from 2016, while the city region population is projected to be 2.75 million by 2030.

The combined urban cores of Gateshead and Newcastle are the key employment area in the North East, and the main driver of the city region growth. It benefits from high levels of accessibility and connectivity; approximately 299,000 people work in the urban cores, and 45% of employees travel to work from outside the two local authorities.

In the future, Newcastle will benefit from the North of Tyne devolution deal. Implemented in 2018, the deal will bring Newcastle, North Tyneside and Northumberland together under a Mayor, and will bring an extra £600 million of investment to the region over the next 30 years.

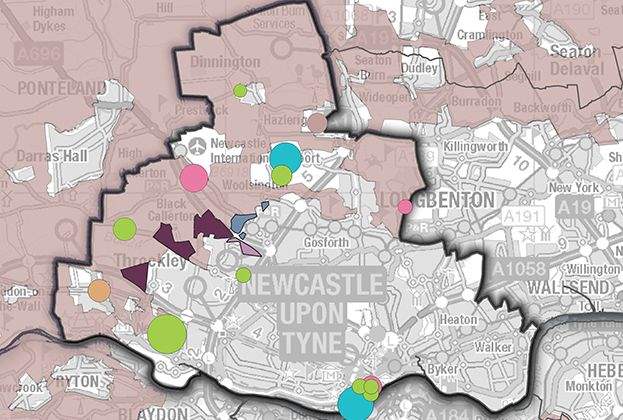

The powers devolved to the new Combined Authority will include land acquisition and disposal, and the ability to establish Mayoral Development Corporations to serve North of Tyne’s housing and regeneration ambitions. Four Neighbourhood Opportunity Areas in Newcastle have already been identified in the Core Strategy, which have potential to deliver over 20,000 homes.

.png)

Residential development has increased rapidly and is now exceeding local plan targets

Source: MHCLG

The city in context

Comparison with the other nine UK core cities and additional strong regional centres such as Oxford, Reading and Edinburgh demonstrates Newcastle’s strengths, and the areas where the city faces challenges.

The city is becoming more prosperous, with earnings growth of 26% between 2007 and 2017. Of the comparator cities, Leeds is the closest with earnings growth of 22% over the same period.

Rising earnings combined with moderate house price growth means Newcastle has relatively affordable housing. Median house prices are 5.85 times median earnings, in line with Liverpool, Sheffield and Glasgow, and significantly more affordable than the most expensive core city, Bristol, which has a house price to earnings ratio of 9.11.

The city has also benefitted from pro-development local government. Following the downturn during the global financial crisis, housing delivery has risen strongly from 2013–14, and for the last two years, new housebuilding has been equivalent to 2% of existing housing stock. None of the other cities in the comparison group have a housebuilding rate higher than 1.6% of existing stock.

Although Newcastle has a low proportion of the population educated to NVQ4 or above (33.8%), it does manage to retain a high proportion of graduates, with over 36% of students choosing to remain in the city after graduation. The city also has a global pull; nearly 30% of students at Newcastle University are international students.

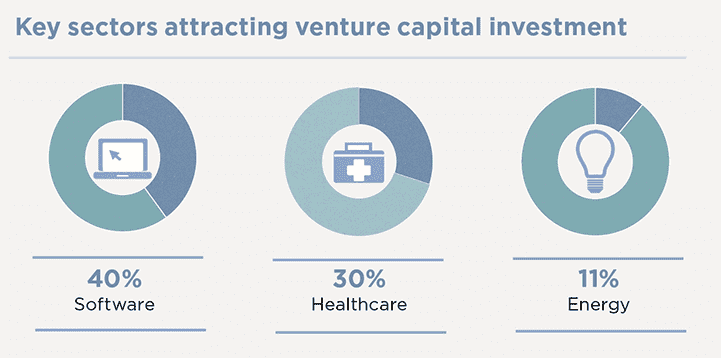

New access to finance should stimulate the city’s tech sector

Savills Research

However, Newcastle faces several challenges that need to be addressed to keep up with other competing cities across the UK. In 2018, £27 million in venture capital funding was invested in companies headquartered in Newcastle, outperforming Birmingham, Leeds and Glasgow.

But Newcastle still has a business start-up rate per capita that is lower than all the comparator cities. This may in part be due to the lack of appropriate commercial space to attract new occupiers. The 2010–2030 Core Strategy identifies the dated nature of some of the city’s office stock as a challenge.

The provision of more high-specification, serviced and flexible office space, concentrated in the urban core, will be essential to the strength of Newcastle’s emerging technology and media sectors.

In addition to office space, the Core Strategy for Newcastle specifies retail development as a particular priority for the urban core. It sets out a desire to improve the range, quality and quantity of retail provision, with the specific ambition of increasing the amount of comparison retail by 50,000 sq. m. of floor space. Our analysis suggests that future developments should seek to provide flexible retail and leisure formats that are currently under-represented in the city centre, as well as increased cultural, community and civic uses, rather than solely increasing traditional retail supply.

Given the importance of Newcastle city centre as an economic hub for the wider North East region, creating an urban core that acts as a focus for investment and business, and meets the needs of occupiers and residents will be critical for the long-term success of the region.

The growth of the tech sector

Newcastle has seen a significant growth in the tech sector over the last five years, with digital tech start-ups increasing by 154% from 2011 to 2016. With the long-awaited JEREMIE2 funding now live, new access to finance should also stimulate the city’s tech sector. The £120 million fund could support 600 businesses and help create around 2,500 jobs over the next five years.

The then minister of state for digital, Matt Hancock, named the North East of England the fastest growing tech hub outside of London. Business growth and collaboration have been stimulated by a number of support networks including Digital Union and Dynamo, companies that specialise in raising the profile of members and the sector as a whole.

The recent establishment of the Newcastle Tech Trust, a group of experienced founders that understands the needs of early-stage, high-growth tech companies, is further empowering ambitious technology start-ups and scale-ups. Newcastle is home to the only FTSE 100 software company in the UK – The Sage Group plc.

Read the articles within this publication below

.jpg)