New London locations are attracting a wider range of prospective tenants

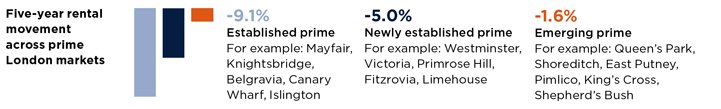

Across the London region, rents in newly established and emerging prime markets have generally performed better than the established areas over the past five years. Tenants have become more footloose and budgets have tightened in light of underlying levels of political and economic uncertainty. This has also reduced the dominance of tenants employed in London’s financial sector.

As a consequence, there has been a change in profile, spending power and behaviour of corporate tenants, in particular. While they have remained active in the market, typically they have become either increasingly reluctant to top up their relocation package, or are more likely to take advantage of the flexibility they have in how they spend their allowance. Correspondingly, they have become less inclined to pay the premium associated with a premium address.

Added to this, international tenants, who make up 61% of the prime London market, have often had their expectations set by the quality of accommodation and associated services they have experienced abroad. As a result, new build schemes have introduced new locations to a wider range of prospective tenants.

And yet, in the established locations, there is still demand for appropriately priced properties that deliver the quality of finish typically demanded by a discerning homeowner. Here, demand remains strong for properties in the most sought-after streets where properties come to the rental market infrequently. Good examples of these are the Toast Rack in Wandsworth and Belgrave Square in Belgravia.

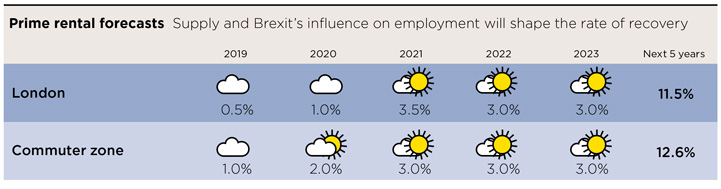

Source: Savills Research | Note: These forecasts apply to average rents in the second-hand market. New build values may not move at the same rate

Read the articles within Prime Residential Rents below.

.jpg)

.jpg)