Residential forecast

Purpose-built, institutionally owned build to rent stock has become a significant component of new housing delivery

Purpose-built, institutionally owned build to rent stock has become a significant component of new housing delivery

Until recently, small-scale private landlords dominated the residential property market, with a small number of large-scale private and institutional investors sitting on legacy portfolios.

Around 2000, buy to let investment ballooned, driven primarily by the promise of inflation-busting house price growth. An income return was the icing on the cake. At its peak, in 2007, more than 183,000 mortgages were granted for the purchase of buy to let stock. That represented an increase of 22% in the number of such mortgages in existence – in just one year.

After the Global Financial Crisis (GFC), the number of buy to let mortgages granted fell and private cash investors became the dominant player. While the number of households in the private rented sector continued to grow at the rate of between 200,000 and 250,000 per year, larger institutions looked on. While they understood the fundamentals of a mismatch in supply and demand, they fretted over the entry barriers.

That is no longer the case. Pioneered by the likes of M&G, Delancey, Sigma, Quintain, Long Harbour and Grainger, purpose-built, institutionally owned build to rent stock has become a significant and increasingly important component of new housing delivery.

.png)

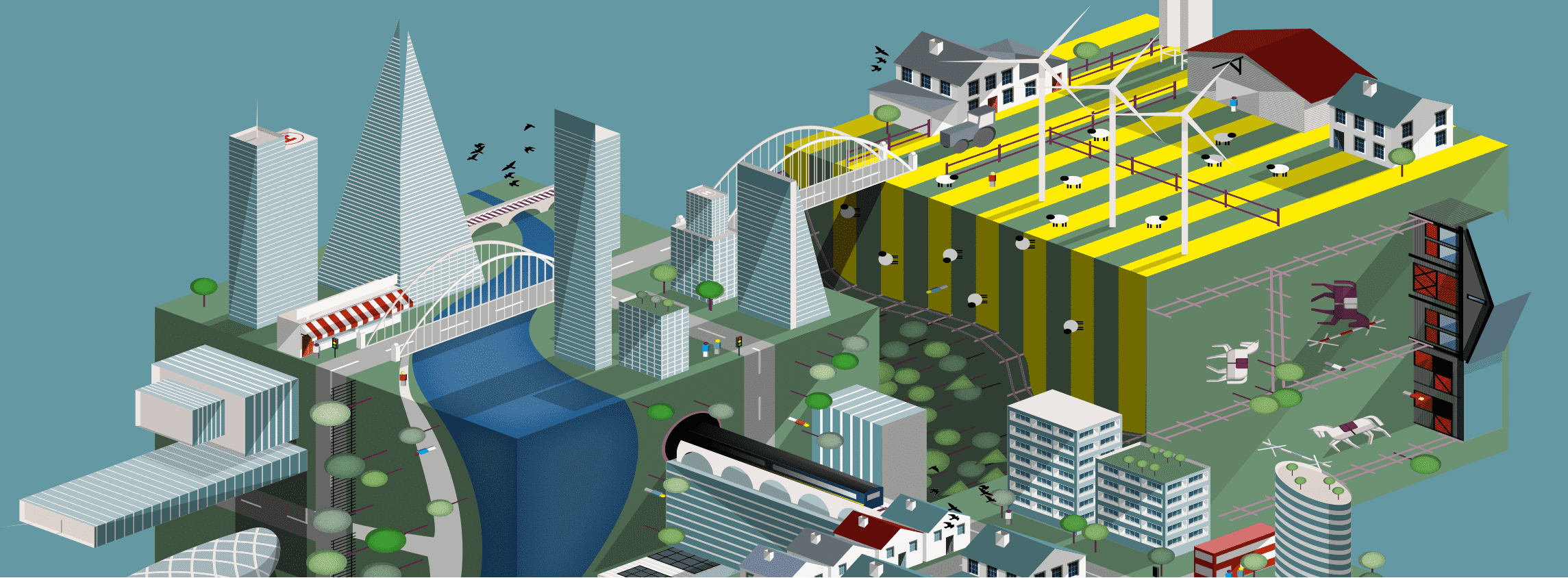

On the rise Build to rent continues to gather momentum

Source: Savills Research using BPF, Molior

To put this into context, in the year to the end of September 2018, the number of outstanding buy to let mortgages grew by just 1.1%. The number of build to rent units either complete or under construction rose by 30%.

There has been innovation in planning, design, delivery, management and branding, laying the foundations for future growth. Equally, there appears to be plenty of capacity for an increasingly diversified offering.

There has been innovation in planning, design, delivery, management and branding

Savills Research

The number of operational build to rent units remains a tiny fraction of the nation’s private rented stock. And, while the range of investors has grown, some of the largest owners of multi-family in the US remain noticeable by their absence in the UK, as do the big pension funds.

The focus has also shifted from an investment perspective. In this new age of residential property investment, the emphasis has shifted to delivering a competitive long-term income stream. Since 2011, there has been a healthy margin over gilts, though achieving that has required investors to take on the risks inherent with developing and delivering a new product and matching that to demand.

With interest rates and gilt yields expected to rise gradually over the next five years, all property asset classes will see some upward pressure on yields. Even though there are acknowledged risks around regulation, what sets build to rent apart is a potential for rental value growth underpinned by structural change in how we live, and compression of the risk premium as the sector evolves and matures.

For the six key residential trends for 2019, please click here.

8 other article(s) in this publication