Prices rise after two-year slowdown

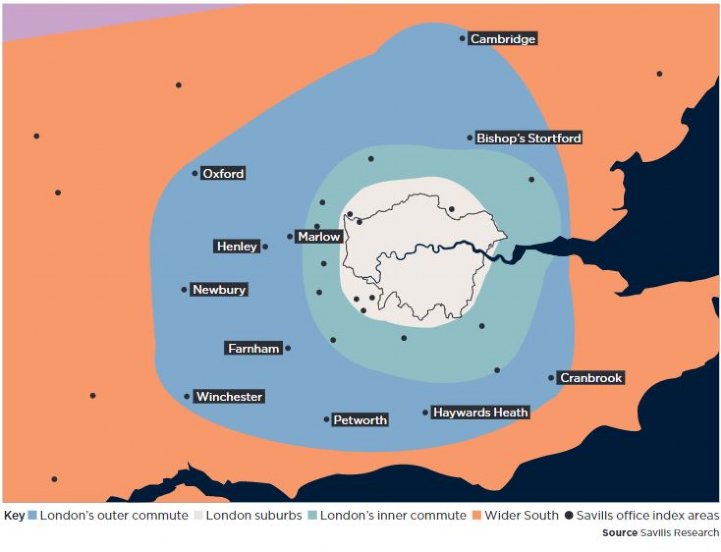

Note: Prime London’s outer commute: properties located within 30 to 60 minutes from London

Values in the prime London’s outer commuter zone have risen for the first time in more than two years, despite ongoing price sensitivity. They increased by 0.4% in the past quarter, leaving them down just 0.3% in the past year. This compares with a fall of 1.2% at the same point last year.

Brexit appears to be the most significant challenge. In a recent survey, two-thirds of Savills offices in the region – typically 30-60 minutes from London – say that uncertainty surrounding Brexit is the biggest difficulty they face as the stamp duty changes appear to have been absorbed into the market during the past five years.

The very top end of the market has shown signs of levelling out. Properties in the £2m-plus price band have increased by 1.7% in the past three months – the first significant rise since the EU referendum. Annually, values have fallen by just 0.3%, a big improvement on last quarter when the figure was -3.3%.

The market is dominated by local needs-based buyers. But as one in seven of prime buyers in the area moves from London and more than one-third still travel to work in the capital, the weakness of the prime London and suburban markets has weighed on buyer sentiment.

This said, more realism from those selling in London has underpinned activity, particularly from those in search of more space. Some 81% of buyers in this area have children, more than any other area in the country, and almost half are upsizing.

Prime price movements (to June 2019)

Price monitor

Note: Prices to June 2019

Source: Savills Research

The strongest performer in London’s outer commute has been Henley-on-Thames, with values 4.3% higher than they were a year ago

Savills Research

Pockets of urban appeal

Over the past five years, prime property in the towns and cities of London’s outer commute has outperformed more rural locations, increasing by 11.5% compared with 3.6%. However, it has not been immune to the slowdown. In the past 12 months, values of prime property in the cities of Oxford, Cambridge and Winchester have fallen by an average of 1.6%.

The strongest performer in London’s outer commute has been Henley-on-Thames. Since the extension of the Brexit deadline, there has been an improvement in activity in the riverside town with quarterly growth of 3.8%, leaving values 4.3% higher than they were a year ago.

Similarly, demand has increased in neighbouring Marlow. Prime property prices here increased by 1.1% in the year to the end of June, having remained broadly flat over the past three months.

Elsewhere, the prime markets remained stable. Prices in Cranbrook and Petworth slipped marginally by 0.3%, while those in Bishop’s Stortford, Farnham, Haywards Heath and Newbury have stayed flat during the past three months.

Urban growth: During the past five years, prime property in the region’s towns and cities has outperformed more rural locations

Outlook

A rise in registered buyers and viewing activity this year are positive signs and a cause of optimism. However, for the rest of 2019, we expect the prime markets to remain price sensitive and driven by needs-based purchasers. Heightened uncertainty over what the new prime minister will mean for Brexit, the economy and tax policy will weigh down on market sentiment.

Boris Johnson has already raised the possibility of changes to stamp duty as a means of freeing up the housing market. For some sellers, this may seem like a reason to delay, in the hope that it spurs an increase in demand. But a decision to do so will be weighed against the risks of disruption to the market from a possible no-deal Brexit or, in more extreme circumstances, tax changes in the case of a change in government.

The relative value in the regional prime markets compared with London will underpin future growth. Quality is key in this cautious market, so vendors must present stock of the best condition.

Interested in other areas of the UK?

View all of our latest residential Market in Minutes research here.

(3).jpg)