During uncertain times, the fundamentals of prime are its strength

Adjusting to disruption

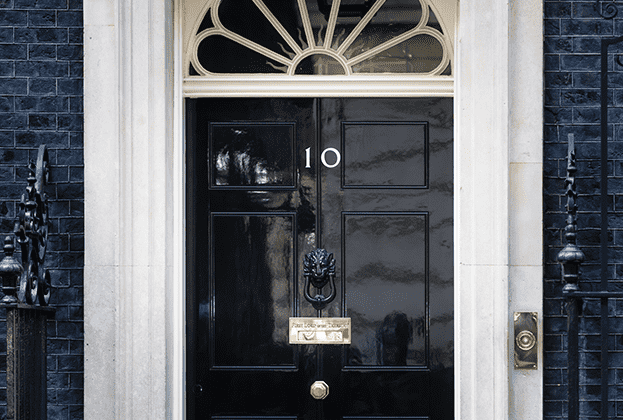

The prime UK housing market has faced its fair share of disruption over the past five years. Most of it has been politically induced: a combination of some things taxation and all things Brexit.

Throughout that period, the bulk of the market has been price sensitive. It has been dominated, but not confined to, needs-based movers, who can only put off life decisions for so long. They have been joined by those who have sensed an opportunity to adopt a long-term view of the situation and take advantage of a less competitive buying environment.

While some discretionary buyers and sellers are sitting on the sidelines, those who are in the market remain serious about it

Savills Research

The latest figures from HMRC suggest that there were 3,600 sales of £1 million-plus property in the first three months of 2019. This is 14% down on the same period the previous year, but the same level as the first quarter of 2014. From this, we can infer that while some discretionary buyers and sellers are sitting on the sidelines, those who are in the market remain serious about it.

Understanding where this disruption has left pricing is crucial to trading sensibly in this environment. It is not a one-size-fits-all answer. A property’s location, size, condition and likely exposure to tax all matter. Our Q&A should help both buyers and sellers get a handle on the state of play across the country. Later in the report, we provide a salutary reminder of the fundamentals that underpin value in London and the country.

This reveals that a £5 million prime property in the central London market is 38% less expensive for those buying in US dollars than it was back in 2014. For those with an international horizon, prime property in New York is currently 41% more expensive than it is in London.

For others with a distinctly UK focus, average house prices in areas served by a rail commute of between 30 and 60 minutes to the capital are £350,000 less than in inner London (see Too much to ask?).

These are numbers that will not be lost on buyers with a keen eye on what constitutes good value.

Elsewhere, we take a look at what is going on in the most resilient markets, Scotland, prime lettings, and what broadband may, or may not, mean for house prices.

Had we confined our report to these topics, we would have left one significant issue unanswered. We are acutely aware that many will be looking for a perspective on what the protracted Brexit negotiations might mean for the market going forward. That seems as good a place to start as any.

Read the articles within this publication below

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)