The 2018 Autumn Budget announced a new Help to Buy Equity Loan scheme will run from April 2021 to March 2023, with two key differences from the current scheme:

- Help to Buy will only be available to first time buyers, completely excluding home movers

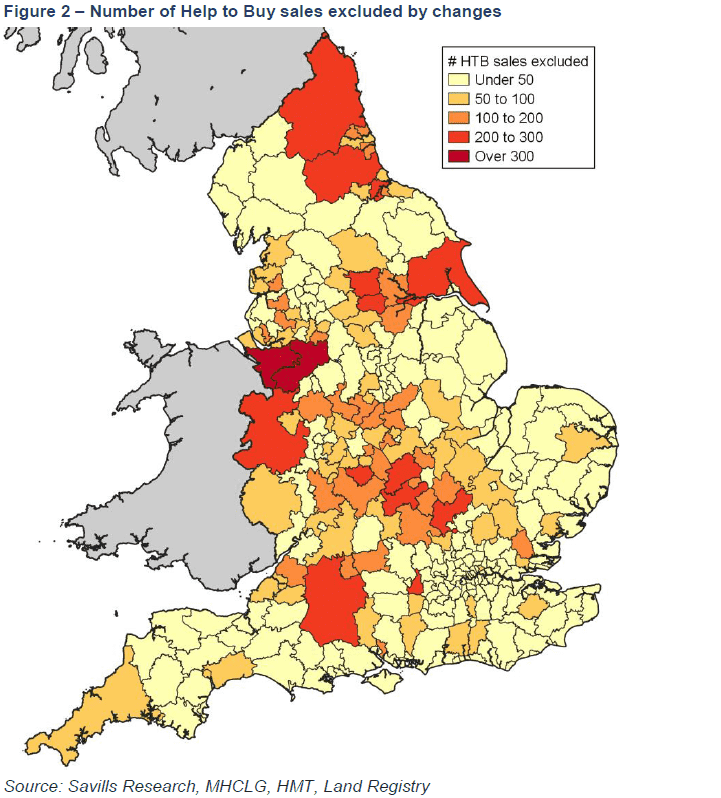

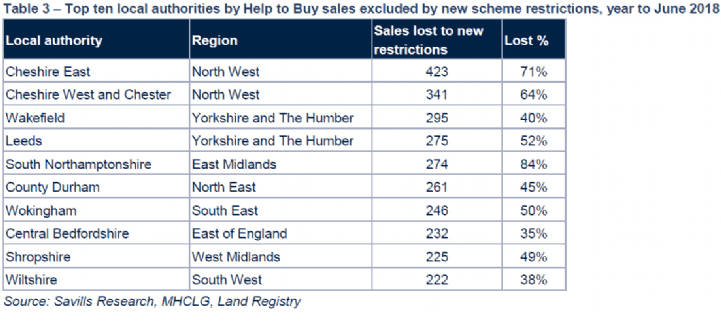

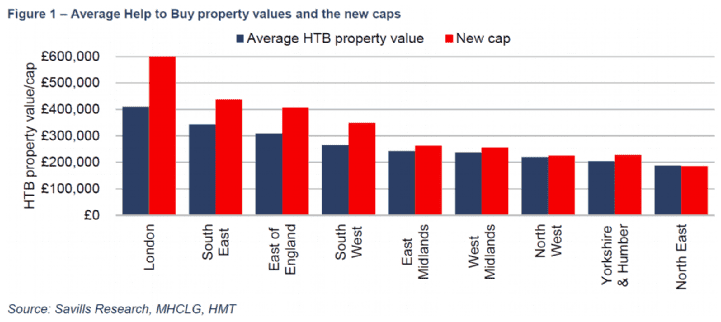

- The maximum value for a Help to Buy property will be subject to different caps in each region.

In this first of two notes, we analyse what impact these changes will have on the Help to Buy scheme and housebuilding. Had these restrictions been in place in the year to June 2018, we estimate that up to 17,000 Help to Buy sales, 34 percent of the total, would not have happened.

The budget also announced that “the government does not intend to introduce a further Help to Buy Equity Loan scheme after March 2023.” We will examine the potential impact of the Help to Buy scheme ending in a later note.

.png)

.png)